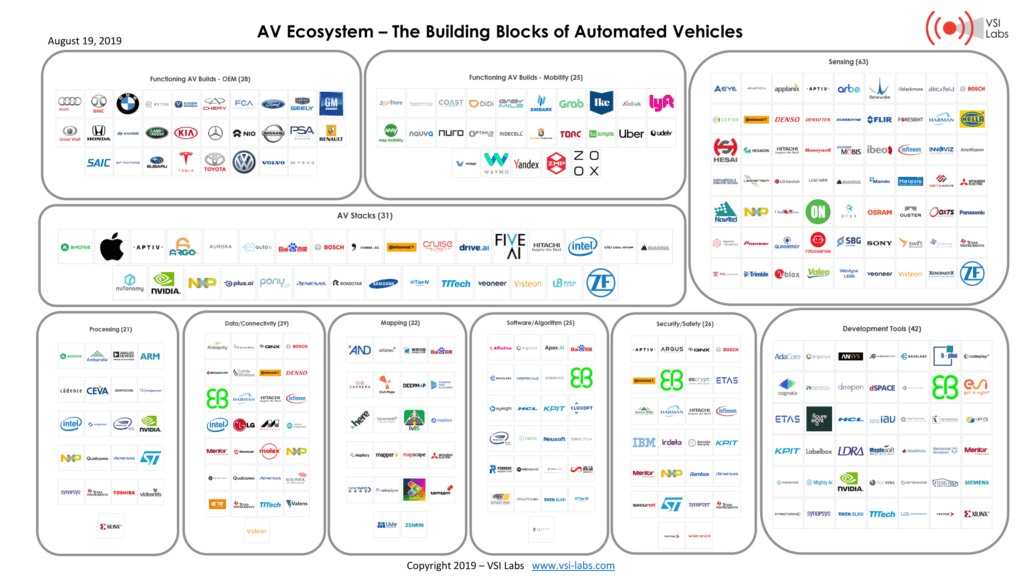

Automated vehicle systems are a complex endeavor for anyone trying to compete in this space. OEMs and traditional automotive suppliers have been very active through tie-ups, investments, and acquisitions designed to improve their strategic position. Large tech companies are also very active developing complete platform strategies as well as aggressive investments through their venture funds.

Beyond traditional auto and big tech, there are literally hundreds of other companies vying for a piece of the AV ecosystem. Many are startups with fresh rounds of capital, whom are feverishly pursuing technology breakthroughs in the areas of sensing, localization, simulation, or mapping.

The purpose of this report is to decompose the current AV ecosystem by looking at the latest version of VSI’s infographic which reflects the major players within the value chain for autonomy. The report provides a high-level analysis of the global AV landscape by explaining each domain of the AV ecosystem.

Latest Landscape of AV Technology

VSI’s AV ecosystem is a vast array of companies both large and small, that offer products and technologies to support automated driving. Companies featured in this infographic are chosen based on their known products or evidence of their commercialization strategy. In addition, it is important to point out that this infographic only covers the in-vehicle technologies and does not include infrastructure, cloud, or enterprise level technologies even though they are an important part of the greater mobility ecosystem.

Let’s decompose the ecosystem by examining the companies and their associated categories within infographic. In the following sections, we discuss the categories and share with you some insight on the composition of each category and what type of products are included.

Functioning AV Builds – OEM

The Functioning AV Builds category represents companies that are building complete vehicle platforms with AV functionality. This field is also divided into two sub-categories; OEM and Mobility.

The companies represented in the OEM category are traditional automotive OEMs that are actively developing AV technologies for their production models as well as future robo-taxi/MaaS (Mobility as a Service) vehicles. Their end goal is to sell their AVs to consumers and/or AV service operators or fleets.

To qualify for AV Builds, the OEM may offer automated features at the production level (typically L2 or L2+) and/or are developing L4+ “robo-taxi” vehicles. These are typically separate business units as rarely does an OEM consolidate their automated activities into one group. Furthermore, the L4+ track is typically based on a mobility model which has huge implications in terms of timelines and go-to-market strategies

Mobility

The Mobility category includes companies that are developing and testing complete AVs for future mobility services. Many companies in this space retrofit current production vehicles and integrate systems from multiple suppliers coupling that with their own self-driving technology stack. Their end goal is to operate AV mobility services for the general public and commercial fleets.

Many of the builds are designated for fleet-based operation as either ride-sharing platforms, robo-taxis, delivery vehicles or shuttles designed to operate within a restricted environment. Some of the largest fleets and fleet service providers occupy this space, as do well-funded start-ups.

AV Stacks

The AV Stacks category includes companies that offer AV hardware and/or software platforms that can handle the tasks of perception, decision, and control. These companies are developing AV platform technology to control multiple domains of AV functionality. Most companies in this space also have their own research AVs for testing purposes. Their end goal is to provide their AV hardware and/or software stacks to OEMs and mobility service operators which are developing complete AVs.

Most companies listed in this category commercialize their AV hardware and/or software stacks and supply these to the companies in the OEM and Mobility categories. Meanwhile, several companies in this category open source their software and are calling for participation and collaboration across the industry to share knowledge and to contribute to their open source AV software repositories. Some companies do this to generate revenue from other sources such as selling the data they collected.

Sensing

The Sensing category is the unsurprisingly largest category of them all. Sensing is large piece of the AV stack and the components here include all formats from raw sensors to complete sensing modules.

Although not shown in our high-level infographic, the sensing category is further defined by sensor type including CMOS/CCD, radar, LiDAR, ultrasonic, IR/NIR (or thermal), GPS/GNSS, and IMU (inertial measurement unit).

Among the many functions, sensors are used to detect the 3D environment around the vehicle as well as other actors in the scene including vehicles, pedestrians, and even animals. For example, vision sensors are ideal for classification of objects as well as scene segmentation while radar provides the best object tracking (the exact movement) of other vehicles.

Processing

The Processing category includes companies that offer processing logic or licensed IP. The processor technologies and types represented in this domain typically include digital signal processing (DSP), field-programmable gate array (FPGA), graphics processing unit (GPU), microcontroller, and a system on a chip (SoC). There are also application specific integrated circuits (ASICs) which are essentially customized instruction sets coupled optimized for a specific computing function. This category would also include processor optimized for computing and AI-based inference model.

Within the context of automation, these processing technologies are used for the areas of perception, localization, prediction, planning, control, AI inferencing, connectivity, security, and safety. Most of the major semiconductor companies in the automotive industry offer solutions (i.e., nodes) for the various domains within active safety and autonomous control. Some silicon providers provide physical chips while others may offer licensable instruction sets for some custom configuration.

Within the context of processing, the demands required from an AV are similar to gaming computers where millions of pixels (or data points) must be processed in real time. Therefore, processing methods often require massively parallel architectures where multiple streams of data can be processed in parallel.

Data/Connectivity

The Data/Connectivity category includes companies offering hardware and/or software solutions that support the movement of data along the in-vehicle networks or via wireless networks outside the vehicle. Some of the companies are “Tier 1” suppliers that make connectivity modules (i.e. gateways) that can handle the data traffic, compressing/decompressing or encrypting messages where needed. Others in the space produce network interfaces and switches that may be a component within the network architecture of the vehicle.

Companies that make external communication modules such as V2X devices and telematics control units (TCUs) are also included in this category. These companies are a vital part of the data connectivity stack as future AVs must communicate with other vehicles and infrastructure. Furthermore, the AV must maintain connectivity to service providers and monitoring centers for various applications including the maintenance of vehicle software assets, or remote tele-operation.

Mapping assets used for automated vehicle functions is vital for performance and safety. Maps for AVs are highly detailed and include a precision lane model so the vehicle can operate when lane lines are not visible or are covered by environmental elements. Furthermore, Maps for AVs contain landmarks and other physical structures from which the AV can localize. Lastly, mapping assets contain other data including speed limits, curve warnings, lane closures and the like. This category includes map companies which provide digital map data for AVs. These map companies harvest, process, and update map data and provide them to OEMs and other AV companies.

It is clear that maps for automated vehicles are gaining in importance to enhance the safety or control the operational domain from which that vehicle can operate within. The Level “2+” category typically adds mapping assets including lane level intelligence and/or localization markers.

Software/Algorithm

The Software/Algorithm category is very broad and includes companies that offer middleware, run-time software, application software, and AI software.

Software products are applied to many of the functional elements of autonomous control. For example, the perception domain includes software for feature detection and classification, while the localization domain has software for pinpointing relative locations.

Many algorithms are applied to perception, such as feature detectors, or object classifiers. Other algorithms are used for predictive applications such as trajectory planning or predictive movements of other actors.

Safety/Security

This category includes companies that offer products and/or services related to functional safety and cybersecurity. Functional safety, ISO26262, has become a core element of active safety and certainly of autonomy. It is further defined by Automotive Safety Integrity Level (ASIL) including ASIL A, B, C, D.

Many of the companies in this space offer safety-rated components (either hardware or software) that are designed to minimize malfunctions, spot abnormal behavior, and even instruct a safe failure. Many of these technologies are applied to the runtime components deep within the software stack (such as real-time operating systems).

There is a growing list of players who have taken on cybersecurity for automotive. Cybersecurity products can be hardware and/or software. Most suppliers of processing logic have this built into the processor but there is gateway security as well as modem security which is coming from partner companies. In the case of L4/L5 autonomy, there should be security assets in the cloud as well.

Development Tools

The Development Tools category includes companies that offer software development tools for algorithms, code generation, development environment, network analysis, data annotation and validation, and debug/compile. There are also companies which offer tools for simulation, modeling, prototyping, recording/examination, and validation/verification.

Development tools are vital for designing sophisticated AV systems. Modeling comes into play early in the development cycle followed by various stages of simulation to test the performance against a virtual environment where scenes, actors, sensors, and physics can be modeled. Some of the simulations offer the ability to test individual components, while others are used to test the performance of algorithms.

Conclusions

AV technologies are worth trillions when you look at the big picture. Every company from technology, telecommunications, data center, IoT, transportation, and commerce is looking to capture a piece of future automated vehicle technology and the mobility trends behind it. Therefore, understanding the AV ecosystem is important for any companies and organizations that are involved or try to enter the AV market.